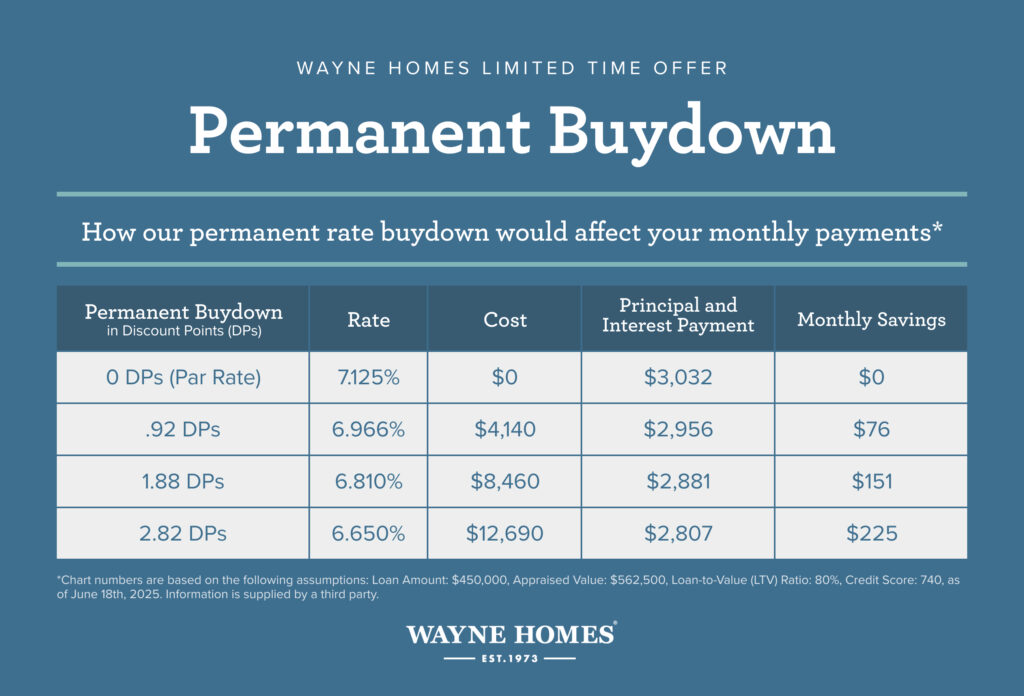

Reduce Your Interest Rates with our new Permanent Rate Buydown

We are excited to share that we are now offering a permanent rate buydown! A permanent buydown will reduce your interest rate for the life of the loan, which means you won’t have to take the risk of rates continuing to be higher after a year or more.

You might have seen temporary buydown offers before. The difference is that these temporary buydown offers force you to return to the higher rate eventually, or refinance with the hopes that rates will have gone down after your rate reduction runs out. While this may be a reality, it certainly delivers peace of mind knowing that you won’t have to worry about that.

While the rate reduction is permanent, the offer is not, so take advantage of this amazing promotion now!

How a Permanent Mortgage Rate Buydown Works

You’re essentially “buying” a lower rate for your entire loan term with a permanent mortgage rate buydown*.

- By paying an amount up front–otherwise known as mortgage points–you can reduce your mortgage rate by as much as 2%.

- The rate never increases as long as you keep your loan.

- The buydown cost is paid at closing. The lender adds the cost of the mortgage rate buydown to your closing costs.

*Exclusions apply.

Ready to get started?

Contact our New Home Consultant to answer your questions or schedule your in-person visit to the nearest model to you.